Education and Work

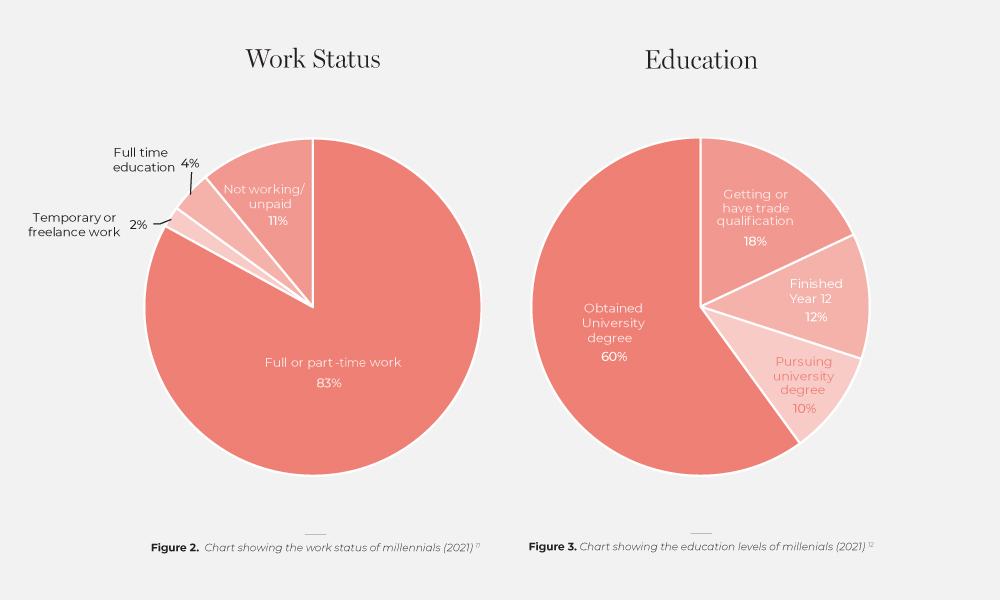

Millennials make up 34% of the Australian workforce and 83% of them are working full or part-time.

The ambition of many Millennials is, however, to take control of their destiny. This is evident in the 33% who are trying to manage several different careers simultaneously. While 32% have experienced a better work/life balance since the pandemic and the same proportion are now working more flexible hours, nearly half (47%) are concerned about their job prospects given the economy in 2021. 9 Baby Boomer parents were great believers in education and it’s not surprising that 60% of Millennials (many of whom have Baby Boomer parents) have a degree.

Finances

With young families, many Millennials are looking to buy a home, but it isn’t easy. In 2016, a cliché of the then Millennial lifestyle became a major news topic.

“I have seen young people (Millennials) order smashed avocado with crumbled feta on five-grain toasted bread at $22 a pop and more.” – Bernard Salt, Partner, KPMG

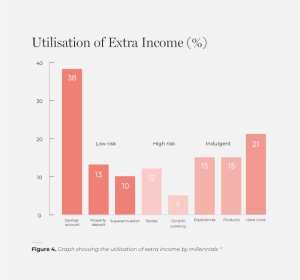

Salt’s quote gave rise to many memes and the famous Avocado Index of property prices which stated that at the price of $22 each, it would take 45,509 avocados on toast meals to be able to afford an average priced home in Sydney. To look at the data another way, when their parents (Baby Boomers) were buying a house, the average house price was 6 times the average full-time annual income. For today’s Millennials, however, the average house price is 13 times the average full-time annual income. The pandemic has only made the situation worse for Millennials as while 23% have increased their spending, 43% have reduced theirs. Nearly half (46%) their savings would only last them one month or less 18 and one in five (20%) have no spare money beyond basic living expenses. 19 The stigma of failure is strong with 38% too embarrassed

to let their friends know that money is tight.

Children

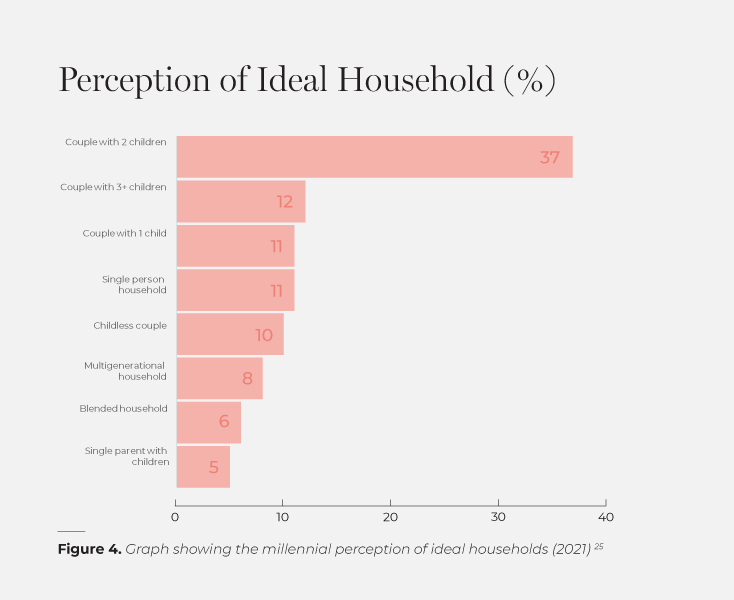

Nowadays, Millennials are sticking to fairly conventional and predominately Anglo-Saxon names for their children. Interestingly, their tastes in home décor and design reflect similar themes. The children of Millennials are known as Generation Alpha and are currently aged under 12. Apart from being digital natives, the defining characteristics of this generation are still to emerge.

The popular names Millennials are currently giving their children;

MARKETING TO MILLENNIALS REPORT