Shopping Occasions

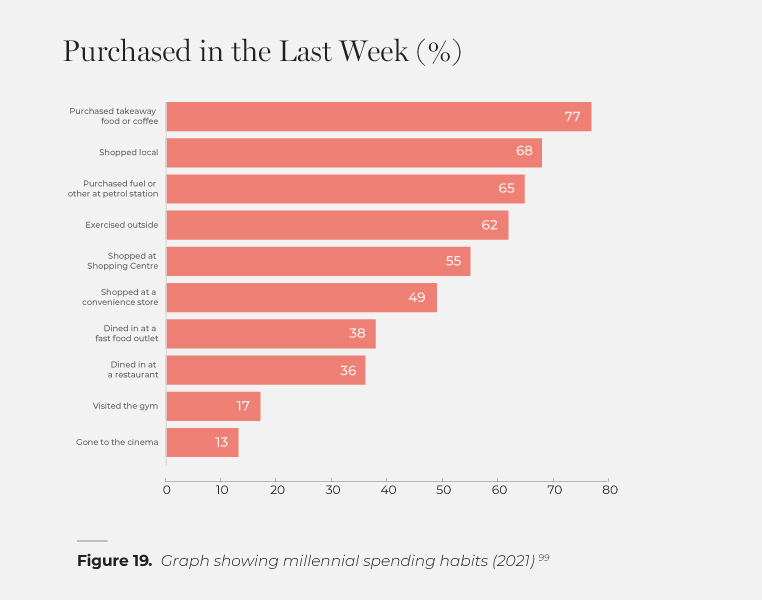

In 2020, Millennials accounted for 35% of the total spending by Australian consumers and this will rise to 38% by 2030. Despite shutdowns, Millennials still get out and make a lot of purchases every week with takeaway coffee and/or food at the top of the list (77% in the last week). Between petrol stations, convenience stores and takeaways, they have a large number of impulse purchase occasions, and it is interesting to note that relatively few FMCG products specifically target Millennials.

Having grown up in a digital world with easy access to information, Millennials take a serious approach to shopping research. Before spending $100 on an item, 92% will compare prices, 78% will read product reviews, and 72% will continue researching while in-store. Buy Now Pay Later (BNPL) has often been labelled as the Millennial’s best friend and some 56% have used BNPL in the last 6 months.

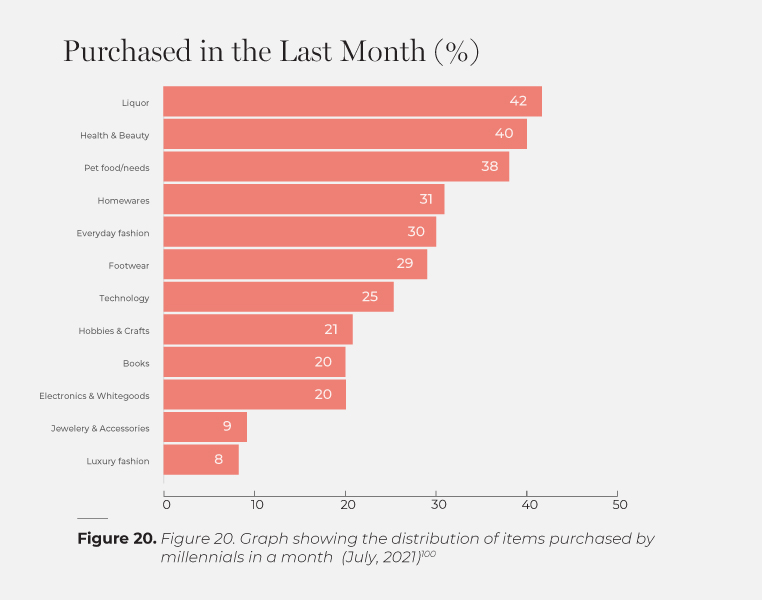

It’s ironic that the mega rich founders of two of the largest BNPL firms are both Australian Millennials – Nick Molnar (30) founder of Afterpay, and Larry Diamond (38) founder of Zip Co. Engagement with BNPL is deepening with the average value of a purchase made by Millennials on BNPL growing by 75% in the last 12 months. In comparison, their average value of credit card purchases only went up by 7%. Despite enduring over 12 months of the pandemic, Millennials continue to make a wide range of purchases outside of supermarket food and beverages.

For grocery shopping, the tight budgets under which Millennials are currently operating can be seen in their focus on price (39%). This may ease over time as product shortages decrease and availability becomes less of an issue for them (currently 15%). Regular shopping patterns have been disrupted by shutdowns however, Millennials are still committed to wandering the aisles of their supermarkets.

Online Shopping

Millennials have been at the forefront of online shopping, though 19% only started shopping online due to Covid-19. The shutdowns associated with Covid-19 have led 24% to using their desktop more than their mobile phone when shopping online. This has contributed to a decline in the number of devices used to shop online from 2.4 in 2019 to 1.4 in 2020. Having more time to research their shopping while working from home, over one in four Millennials (28%) have concluded that they are more likely to get a better deal online than in store.

“Having grown up with the Internet and emergence of online sales events, Millennials will naturally gravitate to where they can quickly and easily find the best bang or their buck with the least hassle. So, it’s no surprise that the online sales are now going neck to neck with offline.” – JESSICA RIX, CONSUMER SHOPPING EXPERT, PAYPAL.

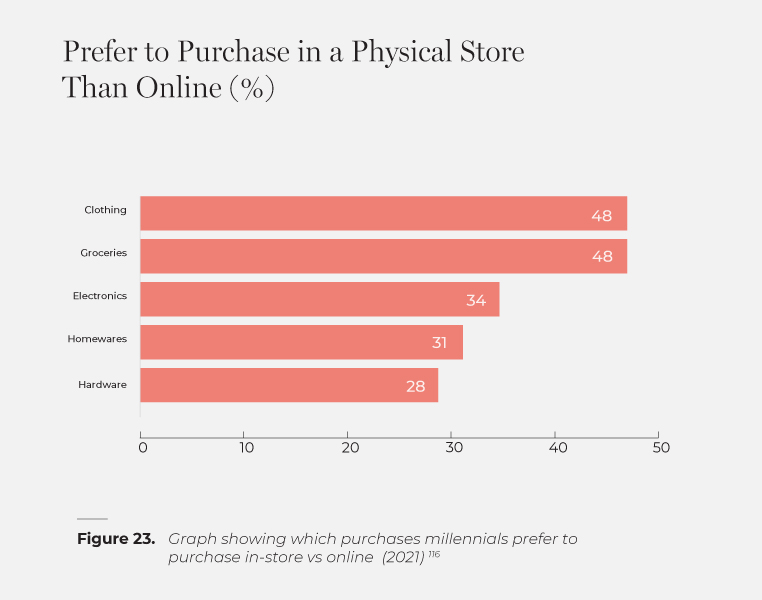

This will have long-term impacts on retailing to Millennials as, post-shutdown, 50% expect to do more online shopping, 38% do more click and collect, and 44% make fewer trips to the shops. Overall, Millennials say they prefer shopping online, and their degree of preference varies by category. In reality, physical stores do still dominate spending. However, marketers should pay close attention to the relative preference levels between categories.

Mobile and Social Shopping

Over 98% of Millennials own a mobile 117 and on average, spend $305 via mcommerce (mobile shopping). The most common benefits Millennials associate with mcommerce are time-saving (41%) and ease (45%).

Buying directly from social media feeds (scommerce or social shopping) is widespread, though on average, Millennials only spend $36/month on it.

Shopping Mindsets

Millennials can be reluctant to spend outside of sales – JESSICA RIX, CONSUMER SHOPPING EXPERT, PAYPAL

Millennials embrace a wide range of approaches to shopping and as they control 35% of the total consumer spend in Australia124, these behaviours impact all retailers. Millennials appear to have three main shopping mindsets. However, it is critical to remember that the same person may have a different mindset depending on the purchase occasion and/or the type and value of the item sought.

The finding supports the move by Coles to cease its paper catalogues that online coupons are the single most popular way for Millennials of redeeming discounts.

MARKETING TO MILLENNIALS REPORT