1. Stay calm, balanced, and future-focused

What do you want your company to look like at the end of the recession? How about three years after that? The answer to these questions should structure your resilience strategy and facilitate all decision-making heading into the economic downturn.

Bain & Company recommend adopting a ‘future-back’ approach that allows your management team to map out a plan of how you will outperform your competitors throughout and after the recession.

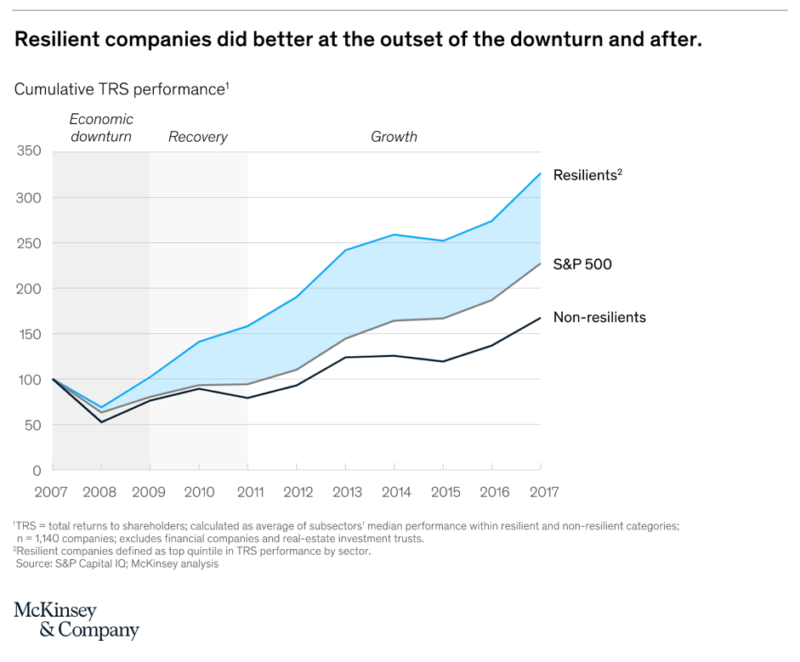

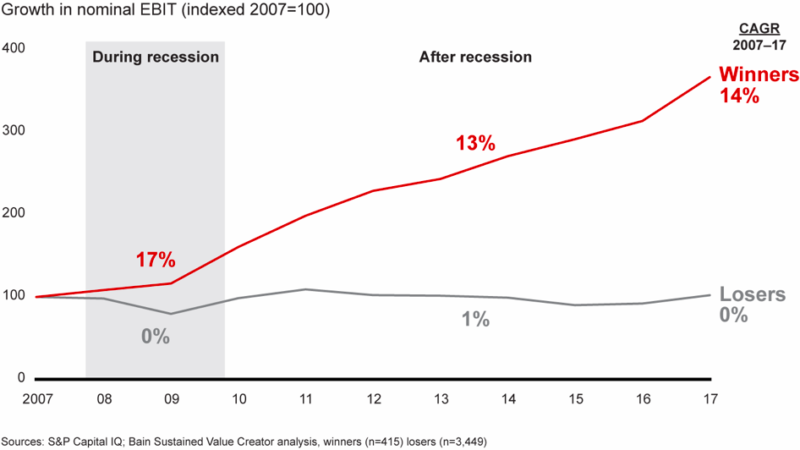

Figure 1. The tangible results of building resilience into your business strategy.

2. Assess your current position

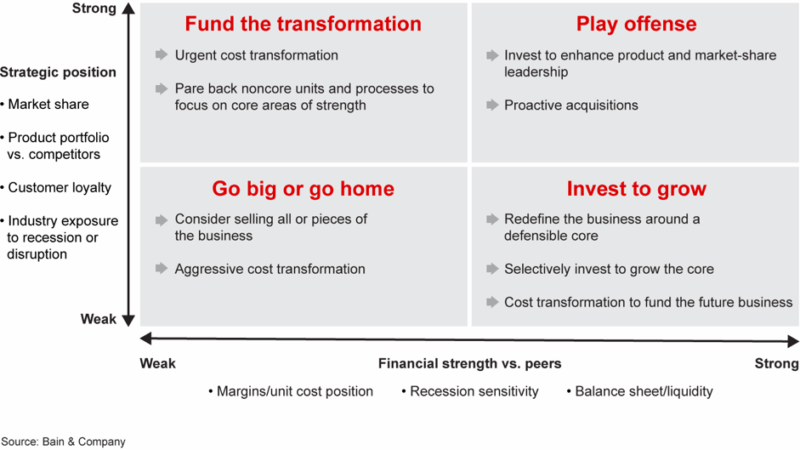

In order to capitalise on an economic downturn, you must first conduct a realistic assessment of your company’s financial and strategic position. For example, if your business is in a strong financial position, but relatively weak market position, this presents an opportunity to focus the business around a defensible core offering, invest to grow this space, and transform costs to fund this future business direction.

Figure 2. Mapping out your recession plan first requires an assessment of your company’s strategic and financial position.

3. Treat cash as king

During a recession, lower sales and less cash are inevitable. Shoring up the financial health of your business in anticipation of trying times is the first, and arguably most important, step you can take towards making sure you come out the other end in good shape.

Thankfully, there are a number of factors you can control.

4. Practice prudent pruning over aggressive cost-cutting

Bain & Company’s study of over 3900 companies during and after the global financial crisis revealed that ‘losing’ companies acted under the ‘misconception that extreme cost-cutting would be enough to survive the storm’. They hurt themselves by trying to ‘slash and burn their way to the other side’, taking desperate measures to save money such as cutting research and development, ruling out acquisitions, scaling back on marketing and sales, and laying off vital talent.

Instead, consider how you can lower fixed costs and strategically manage working capital to increase cash flow and build resilience against demand volatility.

5. Balance your finances

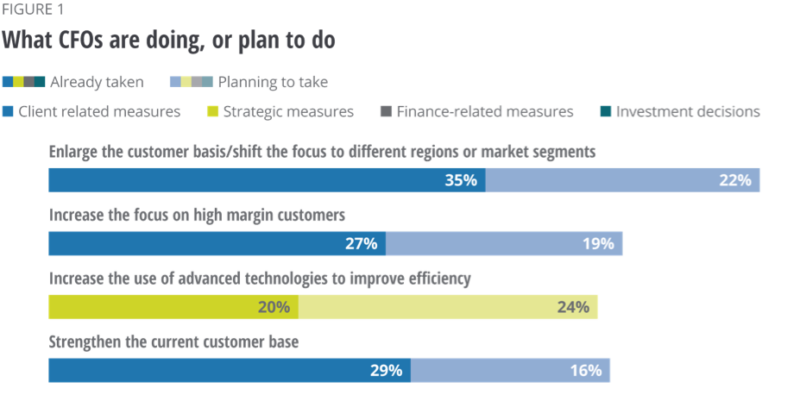

In a Deloitte survey of over 1,000 CFOs, one of the highest priority activities in anticipation of an economic downturn was stabilising their finances. Furthermore, a McKinsey research study on the performance of various companies post-GFC revealed that a common theme amongst winners was an organisational focus on balance sheet management. There are a number of practical actions you can take now to reduce debt, consolidate your position, and improve your overall financial health.

6. Look beyond layoffs

Unfortunately, layoffs and redundancies have inevitably become synonymous with recessions. This doesn’t have to be the case. Layoffs harm not only employees but companies too. This is true for a number of reasons. Firstly, costs associated with redundancies and pay outs – instantly hit cash reserves. Secondly, hiring and training new employees, when the economy returns, presents a significant cost that businesses should avoid. Thirdly, the social consequences of such a move may prove even more costly in the long term.

A Harvard Business Review study indicated that companies that relied less on layoffs and more on pruning operational costs to reduce overheads emerged from the GFC in much stronger shape than their competitors. HBR also encourages companies to consider hour reductions, furloughs, or performance pay as alternatives to lay-offs.

7. Streamline and fine-tune

Bain & Company studied discount-retailer Costco’s strategic approach to simplifying operations and processes during the global financial crisis. Adopting smart streamlining like these will help you to not only steady the ship, but also achieve growth in revenues and earnings through and beyond the recession, just like Costco did.

8. Focus on customer retention

Improving your customer retention by just 5% can increase your profits by 25–95%.

Some business leaders enter recession and hit panic mode, stretching their business in an attempt to acquire new customers. Alternatively, concentrating your efforts on strengthening relationships with your existing customers and remaining focused on your core audience is a more profitable approach that won’t jeopardise the future of your company.

Figure 3. Based on a Deloitte survey of 1000 CFOs, 3 of the 4 top strategies for combatting recession were customer-focused.

9. Focus on core competencies

During the last recession, lagging companies had a tendency to panic and venture outside of their core business, chasing investments in the hottest trends and services before they burnt out altogether.

There is a time and place for diversification – but in a time where efficiency is key, taking the opportunity to perfect your core product and focus on what you know is profitable is the best move towards recession-proofing your business.

10. Be a ‘must-have’

During a recession, individuals and companies are forced to ‘tighten their belts’ to survive. If you offer a “must-have” product or service, the recession is far less likely to impact your business. How can you make yourself “essential”?

11. Embrace technology

Many companies go back into their shell during a recession, entering preservation mode. Alternatively, economists suggest that a downturn can – and should – encourage the adoption of new technologies. Having the foresight to determine which critical processes should be digitized to drive value or improve efficiency is vital to gaining a competitive advantage – and maintaining it when the recession ends.

12. Get on the offensive early

Figure 4. ‘Winning companies accelerated profitability during and after the recession, while losers stalled’ (Source: Bain & Company).

Figure 4. ‘Winning companies accelerated profitability during and after the recession, while losers stalled’ (Source: Bain & Company).

You may have heard the saying “Don’t let a good crisis go to waste”. It speaks to how economic volatility can open up a window to position yourself at a competitive advantage. Our research has identified that leaving the recession in ‘attack mode’ while your peers focus on survival and wait for the cycle to clear is a sure-fire way to gain a competitive advantage.

Download the full report

This report is a compilation of proven resilience strategies used by world-leading companies to weather the storm and emerge from it in a position of strength and prosperity.